Give

Support Low-Income Students

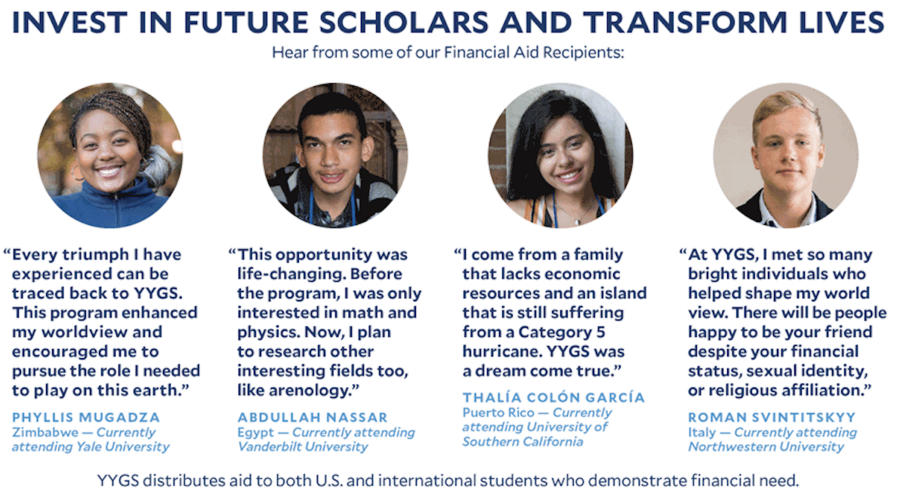

By making a gift to Yale Young Global Scholars (YYGS), you are supporting low-income high school students to attend a program that encourages an open, exploratory, and collaborative approach to learning.

While YYGS is financially self-sustaining and limited funds are available for students in need, generous outside donors provide additional and necessary support to low-income families. We truly appreciate any contribution, no matter how small, which helps supports our goal of providing financial assistance to students and families with financial burdens. Together, we can increase student access to education.

The residential cost per student to participate in YYGS is approximately $7,700 when you bundle tuition, travel, and necessities such as a fan, a cell phone, a tablet, etc. YYGS does its best to accommodate student needs, however the need is constantly growing, and that’s why we need your help. You may make a general gift towards tuition or you may choose where your contribution will make an impact, such as travel or necessities.

Other Ways to Make a Gift Contribution to YYGS

If you are interested in making a gift to support financial aid efforts for YYGS, there are a variety of options for you to choose from, including cash, checks, credit card payments, gifts of marketable securities, and other assets. Please know that these donations are fully tax-deductible. All gifts to YYGS are processed through the Yale Office of Development and include a small gift processing fee.

Your gift can have an even greater impact if your employer has a matching gift program. Find out if your company will match your contribution. If your company is eligible, please request a matching gift from your employer, and send it to Yale’s Office of Development completed and signed with your gift. We will do the rest. Yale’s Federal Tax ID is 06-0646973 and the YYGS designation number is 31270.

For information on different ways to give, such as gifts of marketable securities or other assests, please visit Yale’s Office of Development website. When inquiring about YYGS, please cite the following designation number: 31270.

Educational Access Organizations

If you are part of an educational access organization dedicated increasing access to deserving students, please consider joining the YYGS PACC (Partners For Access). For details, visit our PACC Webpage.

Contact Us

If you are interested in directly communicating with a YYGS team member about supporting YYGS, please email Ami Sobin at ami.sobin@yale.edu. To easily share the YYGS giving portal URL, please use the following link: giving.yale.edu/supportYYGS.